Welcome to True Financial Connectivity

Building Bridges, Empowering Futures, Shaping Tomorrow

Let us discover your financial potential together

We Are Redefining Borrowing & Lending

At KIakia, we possess an in-depth understanding of the unique landscape, challenges, and socio-cultural dynamics that shape Nigeria's micro, small, and medium-sized enterprises (MSMEs). Our expertise goes beyond numbers. We recognize the distinctive needs of the local market and the entrepreneurs driving its growth.

Our approach is grounded in thorough research and deep industry knowledge, harnessed by a dynamic, youthful team that brings both agility and innovation to our operations. This allows us to respond swiftly and efficiently, ensuring that our decision-making process is not only fast but also well-informed. By combining speed with precision, we can provide tailored credit solutions that meet the most critical needs of businesses at exactly the right moment, empowering them to thrive in a competitive environment. Kiakia is committed to being your trusted financial partner who understands, supports, and fosters the success of you and other Nigerian MSMEs.

The Kiakia Story

Founded in 2016, Kiakia is a fully licensed non-banking financial technology company, recognized as one of the pioneers in Nigeria’s digital lending space. Also the leading peer-to-peer marketplace in Nigeria, we specialize in offering both secured and unsecured loans, through our well-structured and easily-to-use peer-to-peer lending platform designed to connect reliable lenders to credible borrowers in a mutually profiting environment. Our innovative approach to finance is designed to provide flexible and accessible solutions tailored to the needs of Nigerian businesses and individuals.

Borrow Responsibly,

Lend Smartly

That swift, smarter, more convenient place to safely borrow and securely lend out in real-time.

Over

₦32 Billion

In transactions and counting

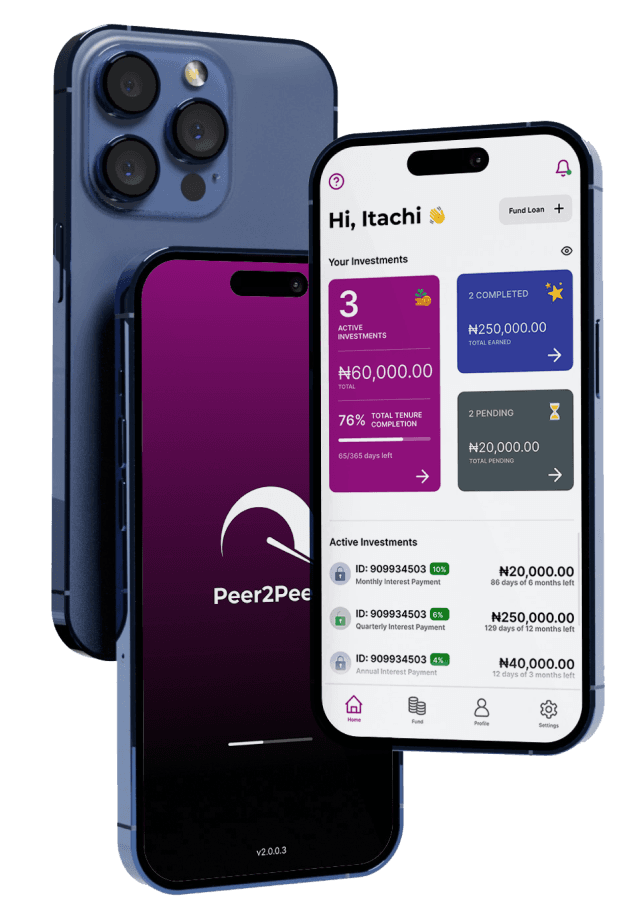

Through the KiaKia P2P App, users can participate in a flexible and centralized lending marketplace, where they are able to negotiate loan terms with Kiakia, then Kiakia loans the funds directly to the borrowers. This model not only eliminates uncertainties that may arise from borrowing directly, but also makes the process hassle free. The system also ensure that the lenders enjoy returns that would have not been otherwise accessible using traditional banking intermediaries. It also enhances trust, speed, and access to credit for businesses and individuals alike.

By leveraging advanced technology and data-driven insights, the KiaKia Peer-to-Peer Marketplace provides lenders with valuable opportunities to diversify their investments, while borrowers—particularly micro, small, and medium enterprises (MSMEs)—benefit from the more personalized and flexible financial support that conventional financial institutions often fail to provide.

The Marketplace

The KiaKia Peer-to-Peer Marketplace is a cutting-edge, app-based platform designed to revolutionize the lending process through a dynamic exchange and negotiation model. Built on the principles of peer-to-peer interaction, the platform offers a seamless and efficient way for individuals to become direct lenders, empowering them to fund Nigerian consumers and MSMEs in a transparent and secure digital environment.

KiaKia Peer-To-Peer™

The Safe and Secure Way to Earn

Ready to take control of your financial future while helping others grow? Join the KiaKia Peer-to-Peer Marketplace today and start lending directly to Nigerian consumers and MSMEs through our innovative, app-based platform.

With the KiaKia P2P App, you can easily connect with borrowers, negotiate terms, and make informed lending decisions—all at your fingertips. Whether you're looking to diversify your investments or make a meaningful impact on the success of local businesses, KiaKia provides the perfect opportunity to do both.

Download the KiaKia P2P App now and become part of a growing community of lenders driving financial inclusion and economic empowerment across Nigeria. Start lending today and watch your returns grow as you support the next wave of successful Nigerian entrepreneurs!

FAQs

What is Direct Debit?

This is an instruction given to your bank to pay funds to a third party (in this case Mono or Remita), at a fixed amount, and on an agreed date.

Is Kiakia reliable?

Is KiaKia a bank?

How do I contact customer support?

Does KiaKia have an office that I can visit?

2019 Best Peer-To-Peer Lending Platform

Award Committee of the Inclusive Financial Nigeria Conference & Awards (IFINCA)